Survey shows top reasons growers take out crop insurance

Andrew Gregor & Matt Trewin,

Have you ever wished you could start the year all over again? Many farmers know this feeling as a result of operating in a competitive sector and in a challenging climate.

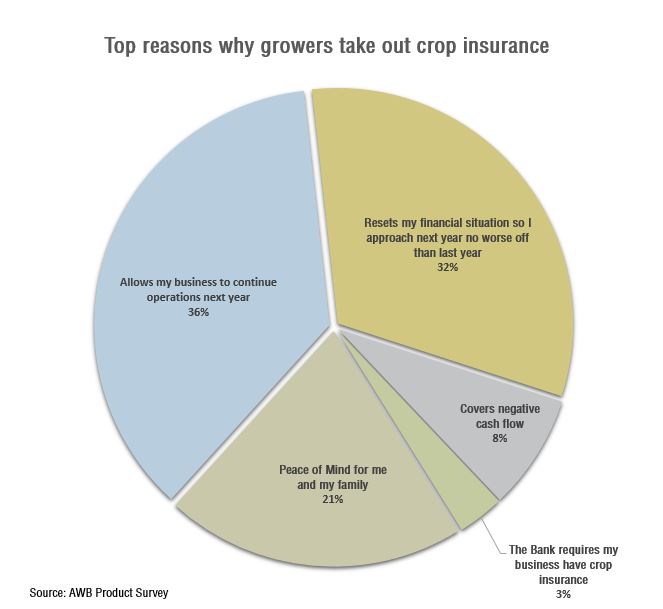

A survey of AWB customers revealed that the number one reason that they took out crop insurance was to ensure they could begin the next year no worse off than their current year.

They said while they did not know what factors they would experience in any given year, what they did know was that there was a way of transferring this risk to someone else, and in doing so, they could be pretty much be sure they can hold their own ground.

The second most common reason growers took out farm insurance, was to ensure business continuity. Farm planning is multi-year and the ability to deliver on this plan depends on a resilient business which is able to withstand unexpected shocks. Farm Management Deposits or other ways of accessing equity in times of unforeseen losses are just a few of the ways to ensure business continuity. Insurance is obviously another.

Unexpected loss of income and uncertainty about the future can be stressful. The third most common reason insurance is taken out is to relieve this anxiety and take one less worry out of their business and personal lives.

AWB and Cargill are the only Australian agribusiness to offer agribusiness insurance and we have grower services covering the major grain growing states of Australia. Growers have told us, through our on the ground representatives and through our research that they want more options to manage their risks. This is why we have introduced new add-ons to our fire and hail policies, namely frost and crop establishment failure cover, which provides insurance that directly meets their business needs. This is a first for Australian agribusiness and more information can be found at awb.com.au/crop-insurance or calling your AWB Representative.

Originally published 28 May, 2018

For more information call the AWB Grower Service Centre - 1800 447 246

New ways to unlock cashflow for your farm business

Putting in a new crop can squeeze the farm finances for many farm businesses. That’s why we are creating new ways for farmers to get access to much-needed cashflow.

Read MoreHow to think more about managing your farm risk

The number of risks involved in managing a modern farm business can be overwhelming. An approach to simplify how to think about these risks is to ask yourself...

Read More