Hand to mouth markets prevail

By Warren Lander

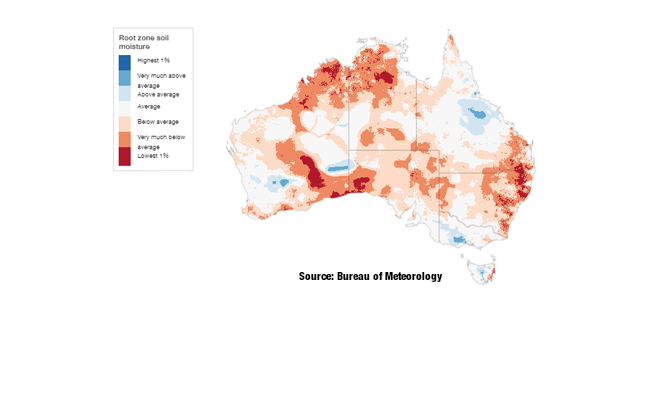

Spring is upon us and that means show times, footy finals and rainfall… Well at least I have two out of three things right! The continued dry weather has some crop forecasters reducing the Australian wheat crop bringing it back to around a 19 million tonne crop and this could drop away even further if rain does not fall soon. With this news coming through, the Jan 20 ASX rose by over $20 in a week, couple this with the local basis matching every move the ASX is making it wont be long before the basis will be at the highs of earlier this year.

Once upon a time, as soon as it got dry in late winter and spring, cash pricing would go through the roof as the domestic consumer would scramble for old crop stocks and try and cover new crop shorts. What we have seen in recent times is a consumer that is either forced to, or more comfortable, living hand to mouth. Part of this is the changing supply chains across the east coast, and some is due to uncertainty with sheep and cattle numbers over the next six to twelve months. We are seeing how they are starting to operate with lower than expected bids for old crop when traditionally a rise in the market should be happening as stocks start to run out and the consumer worries about where the grain is going to come from resulting in a price spike. But over the last 30 days the delivered price for wheat into the Griffith market has fallen by $15/mt to average now around $350/mt, while the farmer to farmer trade depending on location, demand and availability pricing is approximately $365-$385/mt.

Moving forward to new crop, it’s anybody’s, guess but the you would have to think the size of the crop will be similar to last year while the value of the crop could be lower as well as global values are lower than this time last year. Global demand for wheat is lower due to consistent year on year increase of production. Russia and the Black Sea regions pricing are currently USD40-60/mt less than last year, which equates to roughly $70-$80/mt Australian dollar value. This puts Australian grain back to a track Port Kembla pricing of approximate $350-$370/mt. A reduced demand by the flour millers as they have significant coverage from grain that they have had on hand and the China investigation into the barley market is still causing a hangover and there are still large amounts of surplus stock available. If you add all this to the fact it has been an extremely challenging time over the last few years, not only for growers, but also trading companies as shown by the failure of a number of them recently and reports of significant losses, it’s not a great picture. But one thing is for sure, no one is game enough to stick their hand up at the moment to make a call. It’s all hand to mouth.

Grain Markets they are a changing

Does the East Coast market ever go back to a normal season? I guess that depends what you classify as a normal season! Needless to say, the landscape through our part of the grain belt has changed dramatically in recent times and will continue to do so.

Read MoreSentiment drying up fast

The week that has been saw 1-2mm fall sporadically across southern NSW with nothing registering to the north or west. The forecast isn’t showing any encouraging signs in the next week whilst the days are becoming longer and warmer.

Read MoreUSDA surprised the market when releasing their production and end stocks numbers in the monthly WASDE

Wheat futures were catapulted last week after the US Department of Agriculture (USDA) surprised the market when releasing their production and end stocks numbers in the monthly WASDE (World Supply and Demand Estimates) Report.

Read MoreNew Season Crop In Focus

It is still wet in the United States and most areas above Forbes in Central New South Wales are really feeling the pinch due to lack of any decent rainfall. We can only hope that there is a turn around soon in the season for everyone’s sake.

Read More