Is 400/t a chance for wheat futures?

Samuel Reichstein

Australian Securities Exchange January 2019 eastern Australian wheat futures had settled at $393 a tonne, up $71/t during the past two months early this week. During the same period Chicago December 2018 wheat futures have rallied from $273 per tonne to $288 per tonne, clearly painting the picture of a domestic driven rally.

Basis now sits at $105 over Dec 18 Chicago wheat futures, rightly so given the current conditions on the east coast of Australia. With conditions tipped to remain dry through spring there is every chance that futures could break through $400 per tonne providing global values a continued support.

Looking back through the archives, the last time ASX east coast wheat futures hit $400 per tonne was a decade ago in 2008. The contract was a bit different back then, only being a NSW deliverable contract rather than the whole east coast, however as an indicator it still relevant.

In 2008, ASX NSW wheat futures hit highs of $520 per tonne following a massive rally in Chicago Wheat futures, which at the same time traded up to 1200 US cents per bushel in very thin volumes, which compared to current futures at 560 US cents per bushel is a huge number. This was the result of a perfect storm in wheat markets including poor production leading into 2007, tight global stocks, rising oil prices and a surging demand, a situation that many Australian farmers would still remember clearly. Global stocks were tight and there was again concerns of poor production in the major exporting countries, including Australia and as a result the market saw a massive short squeeze as traders and consumers scrambled to cover demand. The market started to sort itself out again in late 2008 when the market found liquidity again and some decent production started to ease the situation.

Since then ASX futures have only managed to get close to $340 per tonne on a handful of occasions, February 2011, March 2014 and September 2015. Production in the Black Sea and particularly Russia has been the common theme in all of these rallies. Over the last decade the market has transitioned through plenty of change, starting with deregulation, growing domestic demand and changing order flow with evolving marketing strategies and the growth of on farm storage.

As we move through to the next cycle in commodity markets, I am sure that we will see spikes in global values as production concerns re-light the market in a tighter stocks environment. It will certainly be interesting to see what the next 10 years has in store.

Originally published 9 August, 2018

AWB PRICE+ Risk Management

For further information call the AWB Grower Service Centre - 1800 447 246

WA farmers lead on new frost cover take up

Western Australian grain growers have been 'early adopters' of our new frost insurance product with 75% of the traditional fire and hail policies electing to add the optional Frost Endorsement.

Read MoreThe tides in wheat are beginning to turn

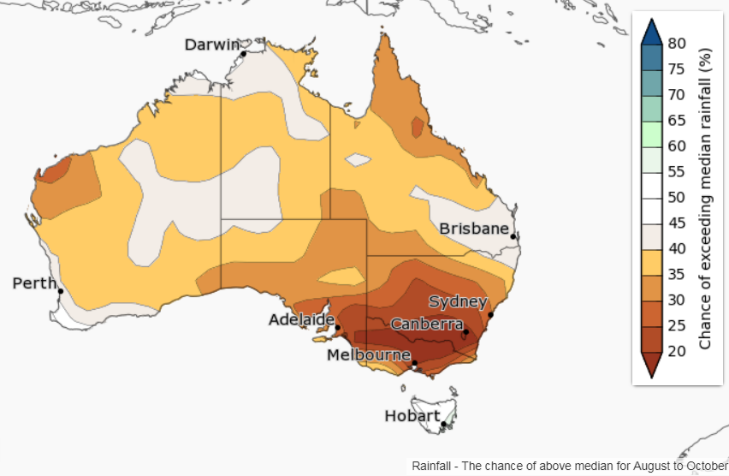

How long will the dry spell continue? It’s a question we ask ourselves each week. And if we trust the latest BOM climate outlook, it looks as though the August to October period is going to be warmer and drier than average for the eastern seaboard.

Read MoreAWB 2017/18 Harvest Pool July EPR update

AWB today are announcing a 2017/18 Harvest Pool estimated pool return for the 25th July 2018.

Read MoreRising prices the path of least resistance

The theme has been consolidation in global Ag commodity futures markets with Corn and Soybeans both closing higher every day last week. While still 15-20% off the May highs, the continued positive...

Read More