The Forecast Giveth and Taketh Away

By James Urquhart

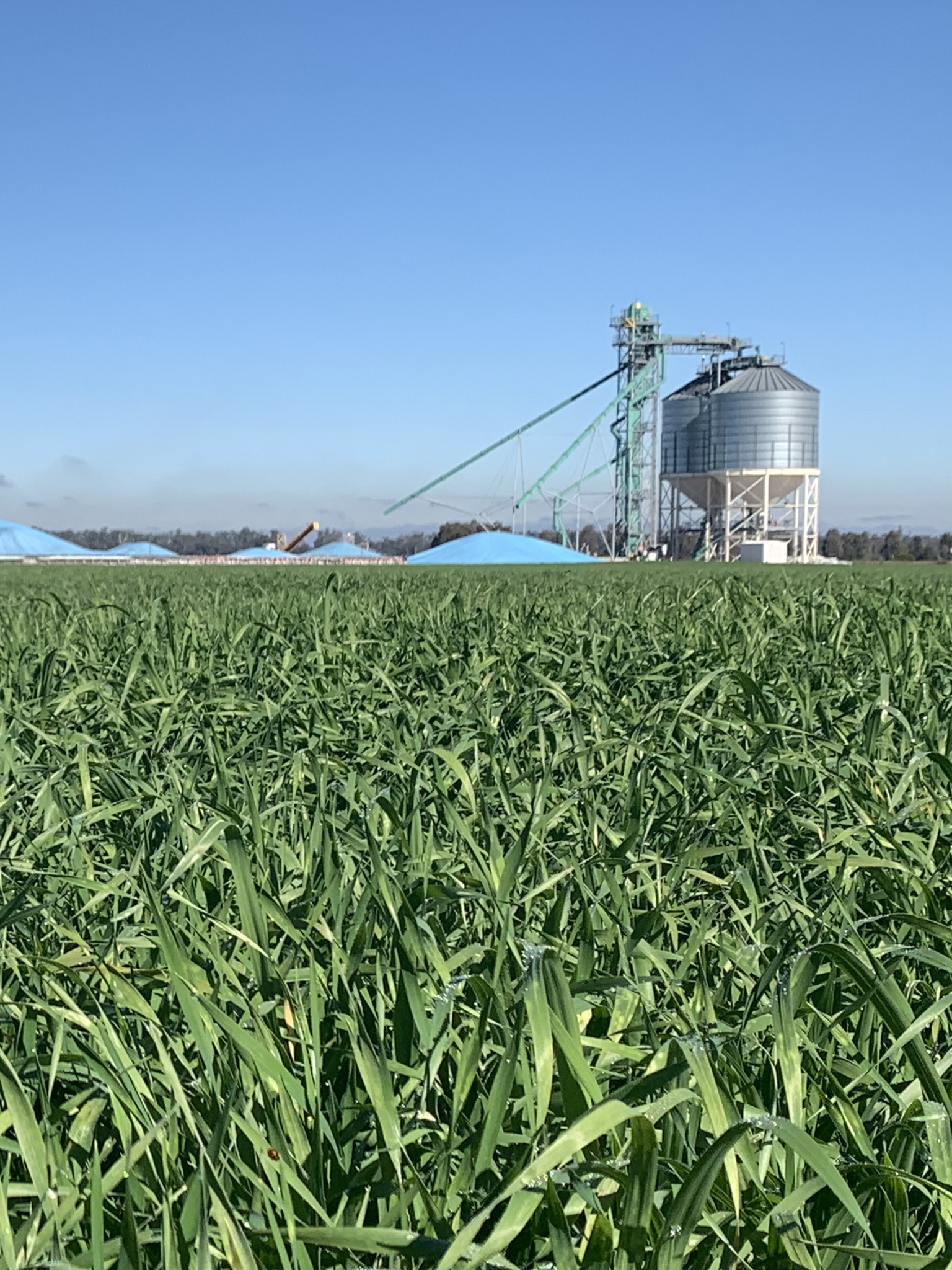

There is no sweeter sound than that of well-timed rain falling on a tin roof - and last week’s rain played a very pleasant tune indeed.

The rain event came with big expectations from the Bureau of Meteorology and was widely anticipated by the market and growers alike. When the forecast lit up like a Christmas tree, with promises of meaningful rainfall across almost the entire east coast cropping area the market reacted aggressively. Local grain markets struggled to find a bid and with a little bit of help from currency and offshore markets, grain prices made a hasty retreat. New crop barley gave up about $15 over the week with wheat closer to $20. One silver lining was canola pricing which ignored the forecast and remained relatively unchanged, holding firm on the back of tightness in global vegoil stocks.

Accelerated by the forecast, last week saw growers stepping up to market another portion of their coming production. Concurrently, the domestic consumer has stepped aside, largely for the same reason the grower wants to sell it – a growing confidence in supply, and the expectation that it probably gets cheaper. Also holding consumers back is some lingering uncertainty about Coronavirus’ impact on supply chains and long-term demand for their finished product. Furthermore, given the significant inverse that remains between old and new crop, it can be expected that they continue to limp through to harvest on a hand to mouth basis.

Upon review, perhaps the rain event itself wasn’t quite as big or maybe as far-reaching as the various forecasts proposed and there will no doubt be some that are left disappointed, but it does achieve what was generally expected of it. For the SA, VIC and QLD crop, where conditions are anything between poor and excellent, this rain was always only intended to buy us time – and it has done just that for the most part. The good crops stay good and for the rest to maintain their current status or improve, they look to the forecast’s hopeful for another inch this month.

For the NSW grower this rain goes a long way to cementing a big crop. From a moisture point of view, the crop feels pretty well set up and if we dangerously assume La Niña delivers a spring rain (but not too much) this crop starts to look like it could get very big. With a NSW crop poised to threaten the record books, we’ll continue to watch the forecasts nervously, perhaps no longer as keenly searching for signs of moisture, but with an eye on overnight temperatures, hoping to avoid damaging frosts.

It is always disappointing for a grain producer to see the market fall away, and when it happens in such a short period of time it can catch sellers off guard who potentially miss opportunities they thought may have been still available in a day or five’s time. However, despite the $15-$20 that disappeared alongside it, it would be a rare grower that didn’t enjoy the tune played by last week’s rain.

Navigating through a COVID harvest

As Australian farmers prepare for another harvest, this one has a feel of something different about it as the world and Australia grapples with a global pandemic.

Read MorePromising seasonal conditions creates employment opportunities in regional Australia

While the world navigates the challenges of the coronavirus pandemic, the agriculture sector forges ahead. The world needs to eat and Australian farmers in various parts of the country looking at one of the most promising production seasons in years.

Read MoreMixed cropping conditions across the country

The theme of rainfall continues to dominate conversations across the Port Kembla zone with up to 25mm falling through the northern half of the zone over the weekend just been.

Read MoreChina is the great unknown in the global wheat and corn market

Rainfalls of 15-35mm across the West Australian grain belt last week helped solidify the ABARES Australian wheat crop forecast of 26.6 million tonnes last week.

Read More