Crops Hit The Wall

By Matt Wallis

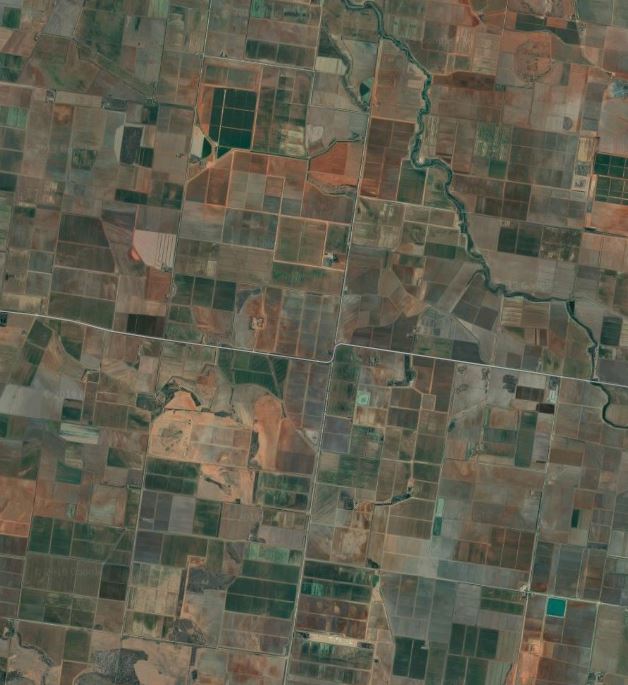

With no substantial rain events behind us and the forecast leaving us forever guessing, crops have ‘hit the wall’ as soil moisture reserves have all but depleted coinciding with above average daytime temperatures, wind and multiple frost events. The current state of the NSW crop is far from perfect and at a crucial stage now of pod filling and flowering while northern Victoria is now beginning to experience symptoms of the New South Wales crop as the conditions push further south. While time may be on the side of those further south of the Murrumbidgee, much like Geelong’s chance of adding another premiership to the cabinet, the hour glass is quickly running out.

Taking into account the current conditions and on the back of ABARES and the USDA recently reducing the prospects of the Australian winter wheat crop by 2mmt to 19.1mmt and 19mmt respectively, we have seen fire added to the local markets. Since the beginning of the month, delivered Griffith markets have risen by $20, Port Kembla and Newcastle track up $32 and Melbourne track up $33. The port zone spread from Port Kembla to Melbourne has been bid as high as $37 over which should further influence the trade flows of the coming crop from south to north and will incentivise growers to deliver outside their natural delivery points. The question now is whether a 19mmt wheat crop is even possible in the current environment? There have been an increasing number of reports starting to filter through voicing concern over the fact that in some areas the moisture profile is insufficient for the crop to even produce a grain yet alone wrap in a bale.

As the old crop stocks dwindle down and the new crop market continually moves with the weather forecast, we have seen heightened levels of volatility present. Leading into the weekend, the ASX traded $15 to the downside as forecasters became optimistic of a change due for the coming week. Again, this forecast has lost its bearings and appears to push further south which in turn we have seen the ASX gain $5 in the early week. Since the beginning of September, the ASX contract has traded in thin volumes within a $27 range reaching a high of $370/tonne.

Barley continues to be a market of mystery with the absence of China and a strong domestic basis putting a holt on any export program. Delivered new crop barley markets are up $20 for the month however almost completely illiquid as the production risk is too high for growers to participate. The drought feeding program continues to attract premiums to the trade although at reducing volumes.

One trait is for certain, while these markets continue to trade in thin volumes and on the back of everchanging forecasts, market volatility should feature heavily in this new year. The long-term forecasts suggest that weather premiums will remain for the short to medium terms ensuring attractive basis levels leading up to harvest.

The new Grower Delivery App puts growers in control

New investment at GrainFlow sites is giving growers extra choice this year when storing their grain and oilseeds.

Read MoreHand to mouth markets prevail

Spring is upon us and that means show times, footy finals and rainfall… Well at least I have two out of three things right! The continued dry weather...

Read MoreSweating the yellow stuff

The crop in focus today is canola as the yellow stuff shoots up to flower and the team has been criss-crossing the state to get a better picture of how the season is playing out in the paddock.

Read MoreGrain markets by the numbers

The USDA has left our domestic wheat production unchanged at 21 million mt which is in line with ABARES latest forecast of 21.19 million mt. However, given the current environment one must ask whether this number is still achievable?

Read More