China, Saudi and harvest heating up closer to home

By James Massina

A very eventful week or so in grain markets as harvest progresses rapidly with a string of clear days through most regions. Cool overnight temperatures throughout much of New South Wales has probably stemmed what should have been the biggest days of harvest to date but as the skies remain largely clear and temperatures begin to warm up, one would reasonably expect tonnages to increase rapidly moving forward and should take harvest to around 20-25% by next week.

The quality profile on wheat has continued to be largely dominated by high protein however as harvest picks up momentum moving south, there are signs pointing towards the more mid and lower protein grades as would be expected. There have been instances of the feared falling number machine making an appearance though fortunately, these have not been widespread nor has there been a sustained need for their use. Barley quality is certainly starting to gain some attention with malt selection rates at this early stage on the lower side of desirable levels for the local maltsters. This is certainly true through almost all port zones currently from New South Wales, to South Australia and Western Australia. Seemingly there have been a number of factors pushing barley out of the main malt grade, be it protein or staining, and time will tell if Southern New South Wales and Victoria can bring the numbers back up. Canola quality is improving as harvest progresses south as there was some low oil come from the north of New South Wales but these numbers appear to be getting closer to the baseline level of 42% as more tonnes come off.

All the talk recently has been centred around China and news reports that they may ban the importing of Australian wheat. These reports are unsubstantiated from a Government perspective though however real or perceived they may be, the market has reacted dramatically and in some regions on some grades retracing over $50/mt. One could argue that the protein market in the northern part of the cropping belt was overdone having rallied on concerns over the weather as well as some spot shorts in the market. Either way, pricing has reverted to levels it needed to find other demand points.

Export demand for wheat has continued to flow with some reasonable volume trading recently into various export destinations, all of which was largely expected demand. There are many looking toward Saudi issuing a barley tender this weekend. This request for offers could be for upwards of 700,000mt and should likely all trade out of Australia and give clear direction for price action on barley. There will be many market participants globally that will be paying close attention to this tender from both an export and demand perspective.

Certainly last week’s announcements shocked many and caught most off guard. Markets appear to have settled for the time being and expect to see as the volume of tonnes increases, engagement from both sides of the market to regain momentum.

Weather events shifting markets

The harvest to date has been punctuated by weather interruptions throughout the cropping belt of New South Wales and Southern Queensland. From all reports it hasn’t been a question of did you get rain, but more of how much was received.

Read MoreRising prices into an increasing crop

Watching the commodities market over the past six weeks has been fascinating for grain market enthusiasts and rewarding for a large portion of growers across the cropping belt.

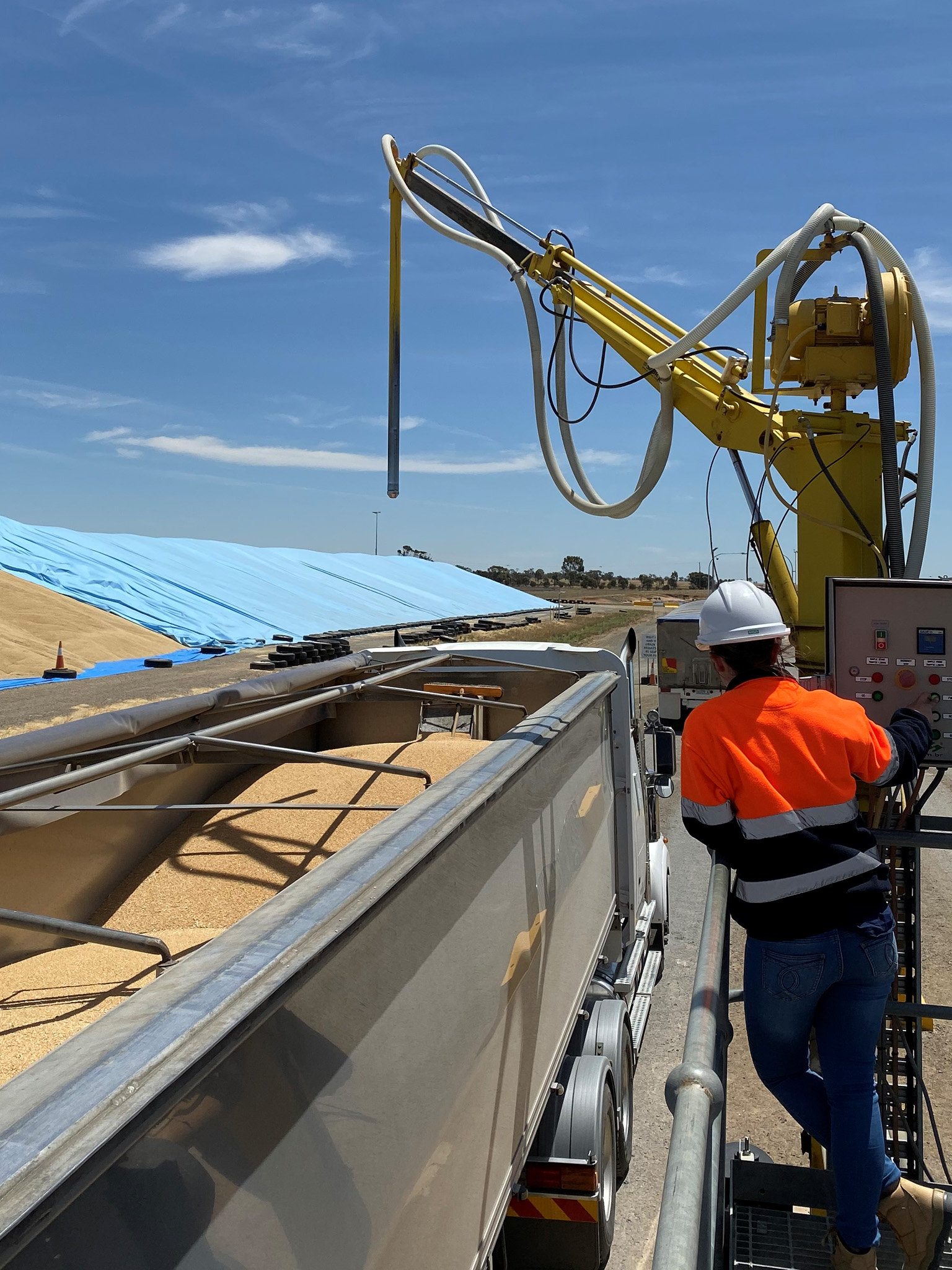

Read MoreGrainFlow: Delivering a harvest focused on ZERO Harm

As harvest ramps up across the GrainFlow network we know that a safe and efficient service over harvest is key for our grower customers.

Read MoreIt's go time for a bumper harvest

All in all, the stage looks set for a bumper harvest in the eastern states with all attention now turning to the weather forecasters for clarity on the harvest outlook.

Read More