Weather-driven rally for grain prices

By James Massina

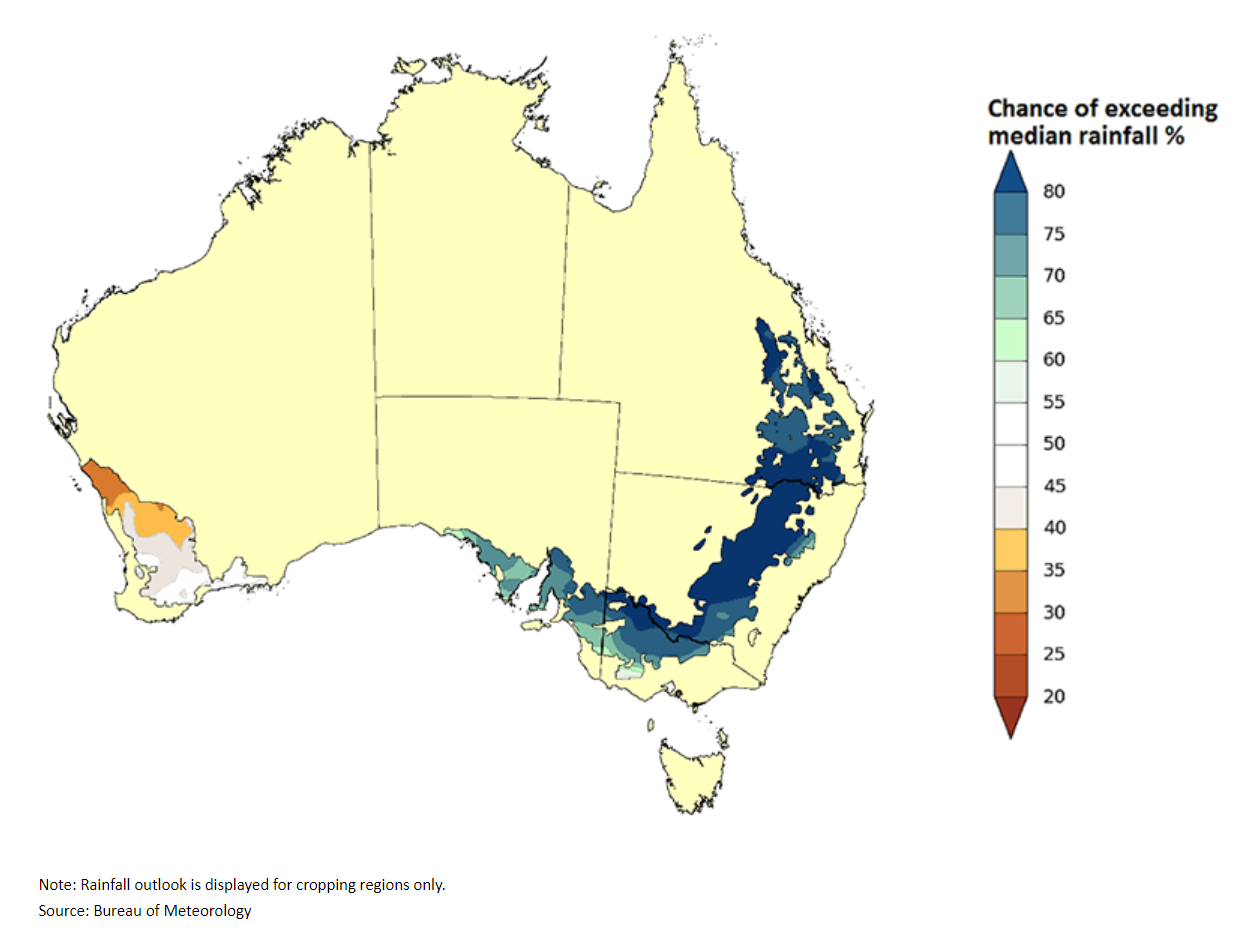

As we see off the month of June and for most people, the end of sowing, the BOM reports that last month produced above average to very much above average rainfall for a large part of the New South Wales cropping belt. Undoubtedly there are some that would appreciate a top up, however the general consensus is that a few days of dry weather would be a welcome break. This may eventuate as a high pressure system begins to dominate over New South Wales towards the middle of the month. Around the rest of the country, Queensland is looking ok, Victoria and South Australia received some welcome rainfall through the month of June and Western Australia is ticking along nicely. There has been plenty of discussion around the Western Australian crop and just how good the start has been in that state.

The key news event out of the last week was the USDA stocks and acreage report which caught the market off guard and had all futures exchanges rally higher. The big surprise came with US corn planted acres being reported as 92.7M which was well below market expectations that were pegged at 93.8M. This had US corn futures close limit up with most other grains and oilseeds following the charge higher. US soybean planted acres also came in below expectations supporting that market. There is certainly very little room for error in these two commodities this year with conditions currently not pointing to the yields the USDA has in their figures to solve the SnD. Wheat had its own challenges where stocks were lower than anticipated but acres were higher. Perhaps confused by those two factors, wheat looked to corn and beans and rallied in sympathy.

The big rally in futures late last week had local cash markets falter for a day as the trade sought to establish fair value, which is not uncommon after such a large overseas move. Somewhat unsurprisingly the old crop markets barely moved a whisker as there appears to be ample cover on by the domestic consumer across the East Coast and most people focused on execution. Despite a couple of small blips, old crop feed barley has traded a $5/mt to $10/mt range in the Port Kembla zone for weeks now hovering around that $280/mt delivered port. With the trade focusing on executing stocks held in the system and the bulk of the unsold old crop stocks being held on farm, the question remains as to how much will be carried through into new crop.

On the new crop, wheat basis came under significant pressure as the move in futures outstripped what was reflected in cash markets here with confidence building in the size of the New South Wales crop. Grower engagement on new crop wheat has been consistent as conditions generally continue to improve across the grain belt and understandably, the grower has been less interested in selling new crop barley. Canola is unquestionably the standout with prices across the country spending most, if not all, of the last month or so in the decile 10 price range.

Generous June Delivers Potential

The month of June has been generous with its rainfall adding valuable moisture to the coffers of the New South Wales broadacre farmer. For some, the rain has been welcomed as a fair dinkum season opener, whilst for others it has consolidated what has already been a very good start to the 2020/21 growing season.

Read MoreBroadacre farmers delight, but where will we store all this grain?

As Phillip Lowe, the Reserve Bank of Australia governor said last week, the performance of the Australian agriculture sector throughout the Covid pandemic has helped underpin the nation’s economic recovery.

Read MoreCrop Forecast looks strong, but will prices hold?

So much of 2021 is yet to unfold, including the all-important spring, however recent rains have the New South Wales crop starting to resemble that of 2020. Unfortunately the same cannot be said for some other parts of the country.

Read MoreVariable harvest predicted

As expected, the production figures for the 2020-21 harvest and prospects for the 2021-2022 harvest are forecast at well above average, however worth noting this is not without regional variation.

Read MoreSA Market Wrap - May

As winter crop planting progresses around Australia, with many areas nearing the end, greater attention is now being paid to new crop marketing options for the coming 2021/22 season.

Read MoreIt's all happening

There’s rarely a dull day in Australian Agriculture and the past few weeks has been no exception, with a lingering summer program seeing both harvesting and planting operations being carried out side-by-side in many areas of the East Coast, with the associated logistics of it all under the pump too.

Read More