Crops being hit by haymakers

By Angus Groves

This past week has seen plenty of action locally with the market showing some extremely bullish signs. Despite the US futures market remaining relatively subdued and the Aussie dollar rallying over 100 points, cash markets almost everywhere in Australia have surged higher. This is without doubt a direct result of most regions struggling to crack that elusive spring rain to finish remarkably good southern crops, as temps heat up and crops begin to show signs of moisture stress. Feels like we’ve been here before, right?

Crops twelve months prior were in a significantly worse state, barely having enough bulk to make hay in most cases. However, with the dry bias for spring this year and hardly a lick of rainfall in September so far, it feels like many of our southern crops may fall on their sword as the days get longer and temperatures begin to climb.

We have seen the reaction in the wheat market too with ASX new crop futures rallying some $30 since the 23rd of August as the Bureau of Meteorology’s spring forecast was released. At the time of writing Jan 20 wheat futures traded at $353 AUD, up a mammoth $30 in the space of just 2 weeks.

The focus will be squarely on domestic production this month as lacklustre global markets remain burdened by large crops, slow demand and a trade war that doesn’t want to end.

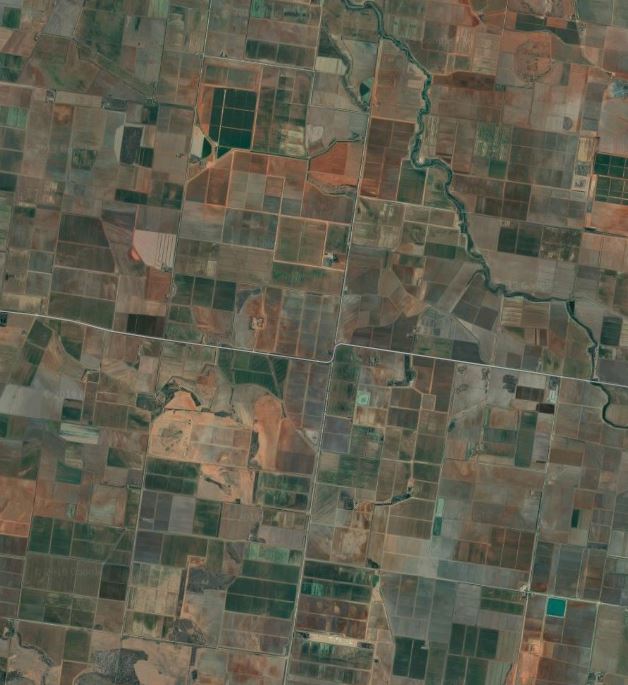

However, we have our own problems back home to worry about with key production areas in southern NSW and Victoria all seemingly hanging in the balance. Just this past week as temperatures have increased, and the howling winds draw any remaining moisture from crops, we have seen a surge in the number of crops being cut for hay.

Currently we are seeing quite a lot of canola being knocked down. It was looking good early with some fantastic biomass. But due to the onset of recent frosts, the dry outlook and the strong demand for hay, farmers in southern NSW are making no hesitation in cutting as much as they possibly can. This is likely to continue as long as the weather forecast remains dry.

The same can be said for cereal crops as well, if there is enough bulk in the crops they will go as well as long as the dry stretches on. If there isn’t enough bulk in the crops, they will make the tough decision to let livestock graze crops in a bid to recoup some costs.

Larger than expected crops in the United States, Canada, Argentina and the EU mean global supplies remain plentiful. And with the Trump-Xi feud unlikely to come to an end any time soon, the U.S will sit on these stocks and participate when the market encourages them to do so. Currently, global wheat flows are being dominated by everyone but us and the US. Both our cash prices are on the rise where everywhere else they are in decline as they compete to win demand business.

Hand to mouth markets prevail

Spring is upon us and that means show times, footy finals and rainfall… Well at least I have two out of three things right! The continued dry weather...

Read MoreSweating the yellow stuff

The crop in focus today is canola as the yellow stuff shoots up to flower and the team has been criss-crossing the state to get a better picture of how the season is playing out in the paddock.

Read MoreGrain markets by the numbers

The USDA has left our domestic wheat production unchanged at 21 million mt which is in line with ABARES latest forecast of 21.19 million mt. However, given the current environment one must ask whether this number is still achievable?

Read MoreBarley Barley Everywhere

With the current state of play in our weather conditions over the past three years, barley has been the mainstay of many in production and financial reward and it has been the liquid gold that many have wanted. Because of this, the barley area has again exceeded all expectation on the East Coast as well as Western Australia.

Read More